Introduction

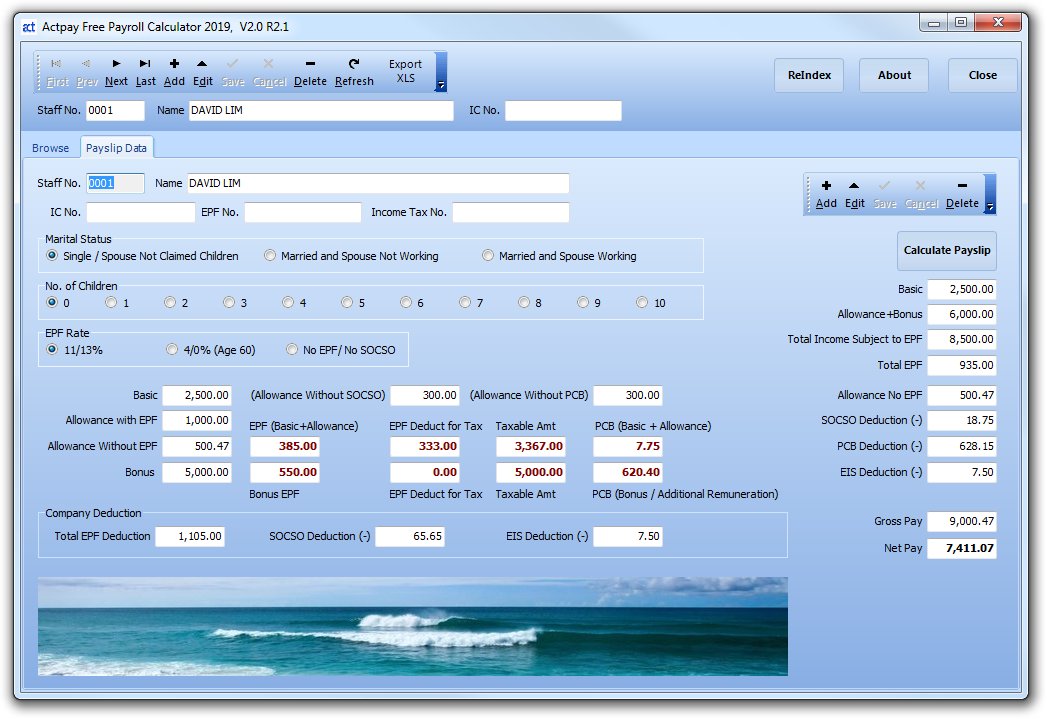

Payroll Software mac software, free downloads and reviews at WinSite. Free Mac Payroll Software Shareware and Freeware. Mar 20, 2021 CheckMark Payroll for Macintosh is a complete payroll program for small to medium-sized businesses. It can run as a stand-alone payroll system, or you can integrate it with CheckMark's MultiLedger accounting package. What's new in this version: Current 2016 version of Payroll software for Mac. When it comes to payroll software for Mac, you can have simple-to-use software with all the tools you need – and more. Make sure you look for cloud-based or online payroll software and check user reviews. Several payroll software systems will give you a free trial, so you can decide whether it's the right package for you. Starting at $1,200 and best for 10+ employees. CenterPoint has features the basic packages don't, such as multiple state payroll, piece rate pay, unlimited earning/deductions, custom reporting, direct deposit, online/mobile time clock, unlimited data capacity, online tax filing, and much more.

Have you got a Mac, and you’re not sure which company offers payroll software?

Did you know that many payroll software providers offer software that is specifically compatible with your Mac?

In this guide, you’ll find out what you need to know about payroll software for your Mac device, including the different software available and their customer reputation.

Let’s go!

What’s in this guide?

Top 7 Payroll Software for Mac

1. MHR

Type: Payroll software

Type of contract: Bespoke

Available services: Payroll services

Google Score: 5/5

MHR has been around since the 1980s, with a rich development they are now a well-recognised company in the payroll industry, with HR services as well as providing payroll software.

By utilising MHR’s web-based software, you can benefit from being able to access your payroll software from any time, anywhere with internet on your Mac device.

2. SageOne

Type: Payroll Software

Pricing: £3 – £13

Available software: Payroll and accounting

Trustpilot Score: 4/5

Sage is a well-known name when it comes to payroll and particularly accounting, with many companies using Sage products as standard in the running of their business day to day.

As Sage One provides a cloud-based service, it means that you can access your accounting and payroll accounts from anywhere, anytime.

This makes it an excellent choice for Mac users, as it is compatible with all internet connected devices.

3. BrightPay

Type: Payroll Software

Pricing: £99 to £299

Available software: Payroll

Software Advice Score: 5/5

Brightpay is a more high-end type of software, and although it is one of the most expensive options to choose from, it is highly flexible and suitable for companies of any size.

This software is compatible with both PC and Mac operating systems, which means you can benefit from HMRC recognised software regardless of your device.

4. Xero

Type: Payroll Software

Pricing: £10 to £27.50

Available software: Payroll

Software Advice Score: 4/5

Xero is a highly rated payroll software company, with many benefits to choosing this company for your software including introduction videos to get you started, support all around the clock and security for your data.

Their accounting and payroll software is cloud-based, which allows you to access all of your essential data from most devices, including your Mac.

They also offer applications for both Android and iOS phones so that you can check out your accounts and payroll on the go.

5. Quickbooks

Type: Payroll Software

Pricing: £10 to £27.50

Available software: Payroll, accounting

Trustpilot Score: 4/5

One of the main benefits to choosing Quickbooks is that it integrates with all of your favourite applications, including PayPal, Shopify and Amazon to name a few.

They also have an excellent rating on trusted review sites such as Trustpilot, with over 700 individual reviews online, 70% of which are in the excellent five-star rating.

They offer an online payroll service which is compatible with Safari version 3.1 and later, which makes it a suitable choice for Mac users.

6. Payroo

Type: Payroll Software

Pricing: Free

Available software: Payroll

Trustpilot Score: 2/5

Payroo is a cost-effective option for many customers, with many different payment options including their free choice, going up to a higher £200 a month cost for companies with over 200 employees.

As Payroo is a web-based platform, it means that you can access your payroll and pension information from your PC, Mac or on your phone or tablet.

7. KashFlow

Type: Payroll software

Pricing: £8 to £21 per month

Available Software: Payroll, bookkeeping, HR

Google Score: 4.4/5

KashFlow offers both accounting and affordable payroll software to their customers, which they claim is easy to use and has many features such as allowing you to work online, gives you updates and lets your employees access their payslips from anywhere.

Because their software is cloud-based, it means that it could be a viable option if you use Macs for your business, with a free demo available so you can test out the software.

You can integrate the software with their bookkeeping software, which means that you can keep everything organised in one place.

FAQ

What is payroll?

Doing payroll is the action of keeping a list of all of your employees, as well as how much they will be paid, and things like sick pay and holidays.

Traditionally this might have been done with pen and paper, however now there is easy to use software which streamlines the process, makes it quick to learn for new business owners, as well as simplifying things for large companies.

What is payroll software?

Payroll software is software that you can use to run your payroll on a monthly or weekly basis.

Using payroll software gives you the opportunity to keep your payroll in-house, but with the accuracy and added features of software created by experts.

Another option is to outsource your company’s payroll needs, which you can compare right now

What are the benefits to payroll software?

✔ Keep your payroll in-house

✔ Some software does a lot of the hard work for you

✔ Use software like SageOne with no experience

✔ Keep an eye on everything from cash flow to HMRC compliance

✔ Make sure that you are paying your employees the right amount

✔ Lower the need for time to be spent on payroll administration

✔ Some software allows you to invite your accountant to collaborate

What is the best payroll software for Mac?

The best payroll software for Mac might depend on several factors, including:

- Customer ratings on trusted websites like Trustpilot

- The flexibility of the software, like where you can access it

- The features the software provides, like producing payslips

- Costs or fees that are included, like whether it is part-managed

For instance, while Payroo might offer free software which makes it excellent for prices, Quickbooks has a much better customer reputation.

This can help you to decide which software is best for you.

What is the easiest payroll software to use for Mac?

According to the SageOne website, their payroll software is so easy to use that they say you don’t necessarily need previous experience.

They offer bespoke training that comes from Sage experts, which can sometimes include helping you to set up and things like using the ‘self-serve’ help centre.

What is the best payroll software for small businesses using Macs?

As the payroll software from Payroo is free, this might be an excellent fit for small businesses that are just starting.

It still has all of the features that you might need for your basic payroll, including extra features like setting up pensions and auto-enrolment.

But the best payroll software for you and your company might depend on many different factors, including:

- The flexibility of the software

- How much it costs

- How many employees you can manage

- The support available

Which payroll software has the most flexibility?

Quickbooks has a wonderful amount of flexibility, as not only can you run your payroll but you can also create and send invoices which you can track to see whether they have been viewed and if they have been paid.

You can also see insights into your cash flow, invite your accountant to view your accounts and complete self-assessments that do the sums for you.

How can outsourcing payroll help me?

If you aren’t sure that payroll software would be your best option, you could consider outsourcing your business needs.

Outsourcing payroll can take some of this pressure and strain off of you and your company, as you can focus on the other areas with the knowledge that experienced professionals are looking after your payroll for you.

It can also save money when you compare with hiring internally, as you will usually be paying a regular monthly amount which would be less than paying a payroll administrator salary.

What is the best way to compare payroll companies?

With all of the choices available to entrepreneurs and business owners today, it can be challenging to decide which payroll company or software is the right fit for you.

For instance, those companies on a strict budget might prefer Payroo, who has HMRC recognised software at an affordable price.

Or, you might want the vast features and flexibility of a company like Brightpay, who is one of the most expensive but has high-quality software and support.

The best payroll company for you will depend on many factors, including the following:

- The size of your company

- Your budget for software

- The experience you have with payroll

- How highly the company is rated

- Their capacity for around the clock support

- The complexity of the software and your needs

Conclusion

In conclusion, there are many possible options for those who need payroll software which is compatible with Macs.

Are you looking for a company with an excellent reputation, or perhaps software that is compatible with other software for things like accounting?

Take a look at the form at the top of the page to compare your options right now, or check out the ExpertSure guides to find out more about payroll.

Now Read:

The IBM Systems Journal revealed that free software and proprietary systems are roughly equivalent in terms of security and reliability. This means choosing a free application over a paid one doesn’t necessarily equate to compromising quality.

This is as true for payroll as it is for other solutions. Payroll, one of the core processes of every business, is particularly expensive. Hence, a free payroll processor can be a huge weight off one’s shoulder when you’re just a startup. At this crucial time, you need to rely on more affordable options so that you can focus on earning a profit to help your business grow. This is where free payroll software solutions, like the ones below, come in.

Free Payroll Software for Small Business in 2021

Free Payroll Program Download

According to a 2020 Hackett Group research, the top-performing payroll organizations have a cost per payslip that is 50% lower than non-top performing organizations. Another 2020 study, this time from Deloitte, underscores the growing acceptance among industries to develop a global payroll strategy amid the onslaught of the COVID-19 pandemic and the accelerating shift toward global digital transformation. To this end, 88% of industry respondents say they either have a global payroll strategy or have plans to develop a strategy. This is in sharp contrast to the 44% figure in a similar 2018 study.

The themes of the two studies highlight the challenges that face payroll departments today. In most cases, however, addressing lingering inefficient processes simply involves resolving the technological limitations that cause these widescale inefficiencies. Those businesses that found this connection are already leveraging modern robotics and automation platforms, AI, cognitive automation and insights, cognitive engagement, and engagement solutions.

When looking at payroll processing software, it’s prudent to future-proof your investment by choosing a cloud-based one. This is when you take into account the fact that businesses with cloud-based accounting solutions have five times more customers than those without. This is why in today’s post, we’ve compiled the top 10 free payroll software for small businesses that you can access anytime, anywhere, on the cloud.

10 Free Payroll Solutions for Small Businesses

1. SumoPayroll

SumoPayroll is a cloud-based payroll and HR management solution. It’s meant to streamline and simplify payroll calculations in as few clicks as possible, with support for attendance and employee information management, performance evaluations, and other accounting tasks related to HR.

The software supports standard payroll models based on prevailing rates and internal policies, but you can also create your own custom payroll model with your company’s specific requirements in mind. Apart from these, employees can access a self-service portal to file administrative requests, where managers can view, approve, and modify them as needed—all online, without launching any other application.

SumoPayroll is a friendly payroll solution for startups. You can enjoy a completely free plan for companies with up to 10 employees. This plan has all the features of the software and has no limitation or expiry.

Key Features of SumoPayroll

- Centralized employee information. SumoPayroll consolidates all employee information in one platform, where managers and employees themselves can access their data. Attendance, billable hours, and performance reports are included, among other things, for easy perusal.

- Custom payroll computations. SumoPayroll supports standard payroll models that comply with existing tax laws and internal policies. You can, however, create a customized payroll model based on your company’s specific requirements.

- Employee self-service portal. Paper files have gone the way of the dodo. Any employee can access a self-service portal to request leaves of absence, tax statements, address changes, and other administrative functions.

2. Capshare

Capshare, while not exactly a payroll software in the conventional sense of the word, allows shareholders to manage and analyze earnings from equity and stocks. This is particularly useful for startups as they can hire key employees using equity compensation. Capshare gives such employees and managers a way to consolidate all data regarding their equity and view them in one simple platform.

Properly classified as a cap table management software, Capshare allows users to see data they need about the health of their stocks. Managers can set specific permissions and access tiers to employees. Capshare also lets companies issue stock, accelerate computations, let shareholders interact with one another, and comply with any and all IRS equity regulations.

Capshare has a completely free plan. This is especially attractive for startups, as the software offers basic features free for up to 20 shareholders.

Key Features of Capshare

- Easy shareholder management. Give value to your shareholders by managing cap tables, equity, tax and regulatory documents, certificates, and lawyers—all automatic and without a convoluted set of spreadsheets.

- Grows with you. Capshare is built to scale and adapt to your needs, whether you’re a startup or a multinational conglomerate. You can upgrade to Capshare’s more premium plans for additional features.

- Simplified record-keeping. Capshare can pull records and documents for each employee’s vested shares by creating a portal for each of them. If an investor asks for an up-to-date cap table, you can make another for them—with just the right kind of access.

3. Microkeeper

Microkeeper is a payroll software with an integrated time tracking capability that can fit the requirements of any industry. This software is designed specifically to suit Australian markets, although it’s also built to accommodate the policies of other countries and regions.

As an all-in-one payroll solution that combines accounting capabilities with time tracking software, employees can clock in and out easily and let the software calculate their billable hours and work. Administrators, meanwhile, can view their workforce’s performance and approve leaves and other requests. It simplifies timesheets and payroll procedures by automatically generating pay statement based on work hours rendered, breaks, allowances, overtimes, absences, and leaves.

Microkeeper has a completely free plan for one user. It contains most features of the Standard plan and features unlimited use.

Key Features of Microkeeper

- Integrated solution. Microkeeper integrates payroll with timesheets, unifying the entire HR experience, so you don’t need to migrate data to and from separate software or use separate HR software.

- Consolidated information. The advantage of a cloud-hosted software is that any user, whether an employee or employer, can track payroll-related information anywhere they need to. You can monitor absences, timesheets, and confirm attendance—all in one platform.

- Complies with Australian laws and regulations. If your industry is based in Australia, you’re in luck with Microkeeper as it supports Australian tax policies out of the box. Otherwise, Microkeeper can also be customized to comply with the regulations of other regions or your company’s internal policies.

4. NolaPro

NolaPro is an ultra-customizable payroll platform that can simplify your payout procedures right on the cloud. NolaPro is so designed that it grows with the needs of the company that deploys it. While being totally secure, it’s also transparent to all its users, whether you’re an employee or a manager.

The main advantage of NolaPro is that almost everything about it can be personalized. With over a hundred add-ons, plus tons of integrations, you can run this software the way you run your business. And it doesn’t stop there. If you need more functions or control that only makes sense for your business and that the software doesn’t support, you can ask the vendor to customize your copy for you. Not enough? How about tinkering with their source code so you’ll have a scalable, personalized payroll software that’s designed exclusively for you?

NolaPro has a free starter plan called Desktop, which is free for one user. It contains all the payroll features a starting business needs, even support for multiple languages.

Key Features of NolaPro

- Customizable solution. NolaPro can be customized to the fine details. It supports over a hundred add-ons and integrations and can even be modified to support functions for your company’s specific needs.

- Open-source. You can scale a payroll solution to even higher levels of customization by tinkering with its source code.

- Secure in the cloud. NolaPro protects your finances and accounts with numerous security methods. Plus, it backs up your data with multiple redundancies, ensuring you get secure, up-to-date data whenever you need it.

5. PaymentEvolution

There is a reason PaymentEvolution is Canada’s largest payroll service. A simple but full-featured payroll system designed for startups, small businesses, accountants, and bookkeepers, it leverages the power and mobility of the cloud so it can be used anywhere and anytime.

PaymentEvolution simplifies payroll by integrating its features with other employee HR functionalities like records of employment and year-end tax slips. Plus, it supports all the modern requirements of a payroll software, including deductions like taxes, CPP, and EI, but you can also create custom rulesets for other deductions. Also, it’s updated all the time with the latest tax tables and automatically patches with no human intervention. And with a 5-minute set-up, what’s not to love?

PaymentEvolution’s Green plan is free for up to 5 employees and 1 user and can remember all transactions inside 3 years. It integrates with only one third-party app, though, so if you’re using other solutions, you may contact the vendor for the plan that suits your needs.

Key Features of PaymentEvolution

- Built for Canadian markets. Canadian industries love PaymentEvolution because it supports Canadian tax laws and deductibles out of the box, including the Canada Pension Plan and Employment Insurance.

- Custom deductions and payroll models. It’s not just Canadians who should be using PaymentEvolution as well, because it can support custom deductions and rulesets, depending on your company’s needs.

- Secure your data. PaymentEvolution’s state-of-the-art security employs 256-bit SSL encryption. Plus, their physical data centers are equipped with video surveillance, biometric access, redundant power supply, climate control, and fire suppression systems, with backups in multiple sites.

6. Payroll4Free

Payroll4Free is a free online software solution that provides a full range of payroll services for small businesses. Offering the necessary tools to process checks for 25 people or less, it has a complete suite of features that you can enhance with different integrations.

Among the features, their subscription plan offers are payroll and tax calculations, vacation time tracking, detailed reporting, and direct deposits. It also has an employee portal, so your staff members can stay updated on their payroll information.

Key Features of Payroll4Free

- Seamless integrations. Are you using multiple software solutions for your accounting processes? Payroll4Free can be integrated with different programs, so you can easily export your payroll data. It also allows users to import employee hours from a time clock file.

- Simplified tax form filing. In addition to computing monthly salaries, Payroll4Free has a tax calculation and form filing feature. Whether you need to handle federal, state, or local taxes, this software can provide you with the tools you require to make it simpler.

- Vacation time tracking. Keeping tabs on employee vacations, sick leaves, and PTO time is no easy feat, especially once you start computing your employees’ billable hours. Luckily, the Payroll4Free system can calculate these factors for the correct number of work hours per employee. This way, you no longer have to make these adjustments manually.

7. HR.my

HR.my is a free yet robust payroll software known for its ability to both import and export payroll information anytime, anywhere. It is essentially an online HR software that allows for an unlimited number of users while getting employees involved in HR matters. Key features include attendance management, leave management, and a time clock.

As a payroll software, HR.my provides you with everything you need in such a platform, from automatic data entry to the creation of payslips. Payroll runs can be done on a monthly, weekly, semi-monthly, weekly, or bi-weekly basis.

Key Features of HR.my

- Forever Free Software. HR.my is free for life as it is crowdfunded by a community of users. It also offers you the freedom to export any data even after you decide to discontinue your account.

- Impeccable Security. The developer puts due emphasis on security, protecting all connections using SSL protocol. Daily backups are also conducted to avoid data loss. It likewise safeguards data privacy through access restriction.

- Unlimited Users. Even as it comes for free, the software allows for an unlimited number of users. All one has to do is to sign up for its Employee Web Account. This way, employees also get to participate in HR functions.

8. Iris Rise Lite

Rise Lite is a free payroll software created for small businesses in Canada with under 20 employees. Providing robust payroll automation and online reporting tools, you can pay employees faster, reduce errors in salary computations, and make tax computation a whole lot easier. It can even save you time by streamlining your T4, CRA remittance, and ROE filing.

Key Features of Iris Rise Lite

- Flexible pay scheduling. If for any reason, you wish to cancel the processing of a certain pay period, Rise Lite will allow you to do this without hassle. You can also use the app to make off-cycle payments and give bonuses on the spot without having to make tax calculations.

- Accurate data entry. Among the difficulties of running payroll is the laborious input of information. With Rise Lite, you can minimize manual data entry and ensure accuracy as the software offers payroll processing automation options. It can even create formulas to handle commissions, deductions, and bonuses as well as resolve payroll discrepancies to further lighten your workload.

- Powerful payroll reports. Sometimes, knowing how to compute your employees’ salaries is not enough. Business owners must also be able to determine if their income is sufficient to support their workforce as well as allow for certain bonuses and increases in allowance. This is why Rise Lite has a powerful payroll reporting feature that helps you get complete business insights as well as keep your payroll scheme on track.

9. Employment Hero

Employment Hero is an HR software with a flexible, easy-to-use, and compliant payroll system. It offers a free plan inclusive of essential payroll processing tools such as employee file management, independent contractor tracking, and paperless onboarding. Known for its highly configurable, user-friendly interface, it also serves as a repository for employment contracts, HR documents, and VEVO checks. Additionally, this freemium product allows access to its mobile app and knowledge base for your convenience.

Key Features of Employment Hero

- Customizable pay schedules. Whether you prefer paying your employees on a weekly, monthly, or fortnightly basis, Employment Hero has you covered. The system supports schedule customization, so you can set your salary timeframe however you want. It is also equipped with employee configuration capabilities so that you can program different salary conditions for full-time, part-time, and casual employees.

- Centralized system for multiple entities. Do you own different companies? Perhaps your firm has many branches? To help you manage all your employees in one convenient platform, Employment Hero serves as a centralized system for multiple entities. It even allows you to configure each business according to their set of payroll options, so you won’t have to spend money on different accounts.

- Streamlined work rules engine. Every business has its own pay conditions. By using Employment Hero, you can automate your payroll processes according to your company’s rules. Just set your overtime terms, conditional pay rates, allowances and penalties, auto pay increases, and leave templates, and the software will do the rest. In this way, you can lessen the time spent on adjusting salaries per employee and focus more on attention-demanding tasks.

10. Wave

Serving over 3 million users and still growing, Wave deserves a slot in our list of free payroll software for small businesses. It is a free integrated business software that offers accounting, invoicing, and receipt scanning capabilities. Ideal for small businesses, independent entrepreneurs, and freelancers, this platform also has a complete payroll system that can compute and keep track of employee vacations, bonuses, and benefits.

Whether a company follows a weekly, bi-weekly, monthly, or semi-monthly payroll scheme, Wave can support it. With an easy-to-use dashboard and available customer support, this software can help users manage payroll information and access banking details quickly and securely.

Wave is completely free. It has an additional payroll module, and while paid, it is a value-added feature for software with a lot of free features other solutions would have charged for.

Free Payroll Software For Mac

Key Features of Wave

- Streamlined computations. Businesses can easily calculate an employee’s vacations, bonuses, and benefits as well as regular pay using Wave. With this platform, team managers can compile attendance reports quickly to make sure that the accounting division rolls out accurate financial reports and pay stubs every time. This feature is especially effective for companies comprised of employees with wide-ranging pay grades.

- Direct deposit capability. Even for small businesses, having to bring thick wads of money to deposit in every teammates’ bank account is tedious, impractical, and risky, to say the least. There isn’t an absolute guarantee that everyone in your workforce will receive their salary on time either. By utilizing Wave, you free yourself from shouldering the burden of depositing your employees’ wages, making it easy for you to distribute their hard-earned and well-deserved monetary reward. To make this more convenient, employers can use Wave to pay their employees from anywhere.

- Self-service document printing. Instead of worrying about completing a mass printing task on time, you can take advantage of this platform’s self-service direct printing feature. Wave grants employees access to pay stubs, tax forms, and other banking information, so they can make sure that all of these details are correct. Also, they can print these documents at their convenience, which allows them as well as their team leaders to focus on their work.

Payroll Software: Where to Now?

Payroll solutions are indeed a staple for most organizations. They have remarkably improved the way businesses process payment, ensuring that all employee salaries and taxes are paid accurately and on time. A crucial factor when it comes to choosing payroll software, however, is the price of such solutions.

Free Payroll Software For Mac

That said, your company’s budget should not hinder you from implementing different software solutions that optimize your payroll processes. With the vast selection of free programs, you are sure to find one that best suits your company’s needs. At this time, SumoPayroll is the obvious choice, with all the benefits that it offers apart from payroll processing. You can easily sign up for a free trial and get to know the features firsthand at no cost and without commitment.

Payroll Software For Mac Free Download

Have a budget already for payroll software? Be sure to also check out our list of the top 20 payroll software solutions of 2021.